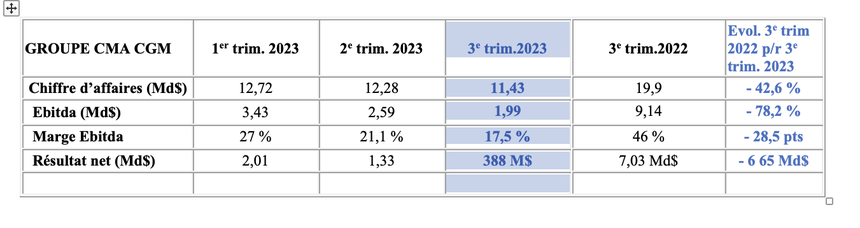

The French transport and logistics group's net earnings plummeted by almost $7 billion year-on-year to $388 million at the end of the third quarter. CMA CGM's performance was neither radically better nor fundamentally worse than that of Maersk and Hapag-Lloyd. The main indicators deteriorated by the same orders of magnitude. However, the fall was less marked.

Between April and June, sales had fallen by 37% compared with the second quarter of 2022, to $12.3 billion all the same. Between July and September, it deteriorated a little further, by 42.6% compared with the exceptionally high levels of a year ago, but remains above the symbolic $10 billion mark, at $11.4 billion. All indicators point in the same direction for the French transport and logistics group, number three worldwide in containers.

Earnings before interest, taxes, depreciation and amortization (Ebitda) came out damaged, liquefying by almost 80%, but remaining at the $2 billion mark. Net income, on the other hand, took a turn for the better, swapping tens of billions for hundreds of millions and falling into a box more familiar to the container industry, a highly capital-intensive sector with high fixed costs.

The Ebitda margin fell by more than 28 points, and at 17.5%, the operating cycle has abandoned the upper reaches of profitability. Net financial debt stood at $0.1 billion at September 30.

Irrational freight rates

It couldn't have been any other way, with freight rates completely irrational. The SCFI, an industry thermometer that reflects the price of transporting a container from Shanghai to some twenty destinations, fell below the $1,000 mark in Q3, to $988, down 58% on last year and 14% on Q2. But still 25% higher than Q3 2019.

CMA CGM's performance during this period was neither radically better nor fundamentally worse than that of Maersk and Hapag-Lloyd, the world's number two and five container lines, which preceded it in the publication of their financial results. The indicators are just as uneven, but the world's number three container line has more than held its losses on most of its indicators.

Maersk, Hapag-Lloyd, CMA CGM, same sea view

Maersk lost $10 billion in revenues, while CMA CGM limited them to $8.5 billion. The Danish carrier's operating profit was cut by almost $9 billion, while CMA CGM's was down by $7 billion.

The same applies to margins: down 32 points at Maersk and 28 points at CMA CGM. The Marseilles-based company does not publish its Ebit (earnings before interest, taxes, depreciation and amortization), a yardstick for assessing profitability.

On the other hand, the situation is less clear-cut when it comes to average revenue per TEU. CMA CGM invoiced an average price of $1,322 per container unit between July and September, half that of a year ago, but very low compared with Maersk, where a container transported brought in $2,000, despite costing over $5,000 a year ago.

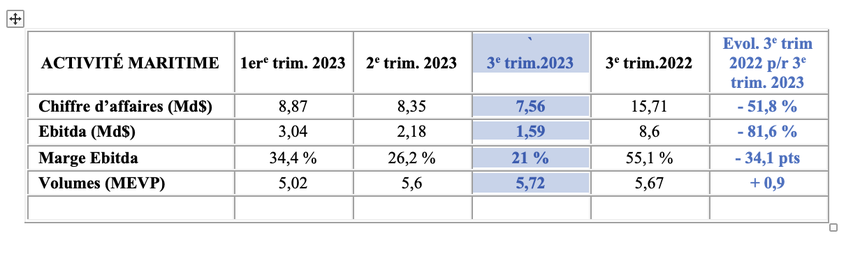

Volumes transported up

The shipping business alone is on the same trajectory as that of the Group, still contributing significantly to it. At $7.6 billion, sales have lost half their revenues compared with the same period in 2022, reflecting the return of freight rates to pre-bubble levels. Ebitda stands at $1.6 bn (-82% vs. third-quarter 2022), and operating margin is down 34 points.

However, transported volumes were up 0.9% on the same period in 2022, totalling 5.7 MEVP. North-South and intra-regional lines were responsible for this upturn, as they were at the beginning of the year, while East-West trades continued to be penalized by the destocking phenomenon in the United States, which is hardly encouraging orders, and inflation in Europe, which has dampened the desire to consume.

A welcome diversification strategy?

Beyond the nuances in the general deterioration of the sector, the horizon is the same for all: macroeconomic uncertainty governs maritime transport, all segments taken together.

"The slowdown in the global economy is likely to continue to weigh on our industry in the period ahead, but transport volumes remain solid. We are pursuing our efforts in decarbonization [$17 billion invested for a fleet of nearly 120 gas- and methanol-powered vessels by 2027, editor's note] and digitalization," says Rodolphe Saadé, the Group's CEO, in the press release issued at the close of the Board of Directors meeting at the company's headquarters on November 10. Our performance remains robust, confirming the relevance of our development strategy in terminals and logistics".

While the years 2016-2019 were punctuated by a handful of acquisitions (APL, Mercosul, Containerships and Ceva, the company's first foray into freight forwarding), the years 2022-2023 alone saw the CMA CGM galaxy studded with iconic brands, whether through equity or controlling interests.

These include Air France-KLM, Ingram, Neoline, Gefco, Colis Privé, Brittany Ferries, La Méridionale, Bolloré Logistics, and terminals at the two American gateways, Los Angeles with the takeover of Fenix, and New York with the acquisition of GCT Bayonne and New York, renamed Port Liberty Bayonne and Port Liberty New York. All in all, more than $20 billion invested to free ourselves from containers, so to speak.

Logistics, stable

The results are still slow in coming. But they are much more stable. Against a backdrop of falling trade, logistics sales totaled $3.7 billion, down 15%. At $348 million, Ebitda was down a moderate 3% on the third quarter of 2022.

"Contract logistics are holding up well, particularly in Europe. Finished vehicle logistics remains on a positive trend, buoyed by favorable market dynamics thanks to sustained demand," notes the press release.

The French group now provides some data on its "other activities", i.e. port terminals and airfreight. Sales were up 5.3% to $526 million, with no breakdown. However, operating profit ($56 million) was down (-58.4%), reflecting the disappearance of container parking revenues, which soared during the pandemic.

Overcapacity, the future driver of freight rates

What air and sea freight have in common is sluggish demand in the face of ever-increasing supply. Overcapacity, which is unlikely to ease before 2025, keeps freight rates under heavy pressure. Market conditions will therefore remain difficult as long as oversupply persists, and even more so in the absence of a recovery in demand, which is not on the agenda for 2024.

While the balance sheet is solid, as CMA CGM maintains, the outlook remains highly uncertain, including for 2024. But the French group is not battening down the hatches as a preventive measure, like Maersk, which has just announced additional job cuts over and above what had been planned.

Or at least, the formulation is much more nuanced at CMA CGM. CMA CGM, one of the shipyards' biggest customers, dares to say that "deliveries of new capacity expected on the market should continue to weigh on freight rates. In this context, we will be focusing on controlling operating costs", it points out.

Adeline Descamps

0 Comments