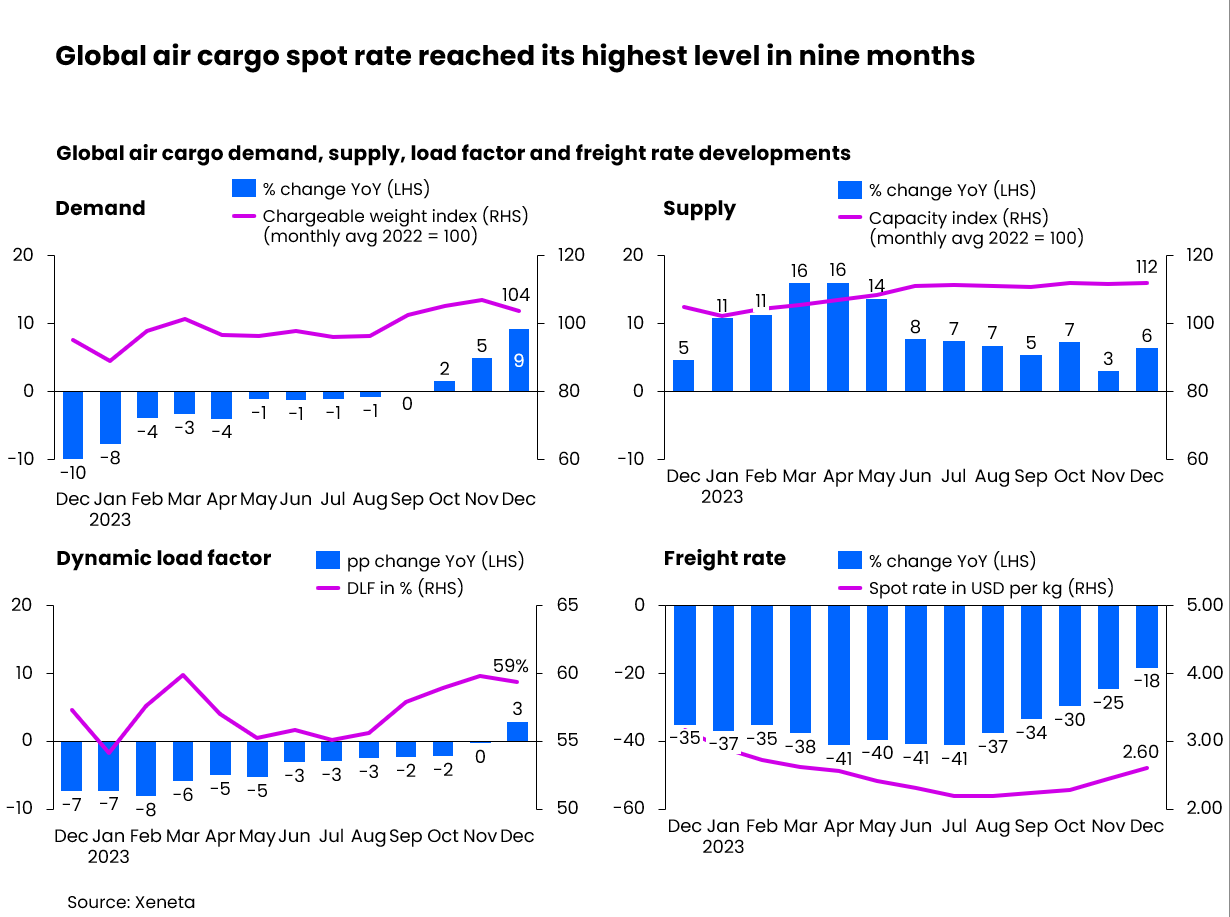

2024 pourrait marquer le début d’un nouveau cycle de croissance économique pour l’industrie mondiale du fret aérien après que l’année dernière se soit terminée avec une hausse de la demande de +9 % en glissement annuel et que le taux spot du fret aérien général ait atteint son plus haut niveau en neuf mois, suggère la dernière analyse hebdomadaire des données de marché par Xeneta.

Alors que l’environnement géopolitique et les pressions exercées sur le coût de la vie continuent de constituer des obstacles importants au commerce mondial, la prévisibilité du fret aérien signifie que l’industrie devrait bénéficier de l’escalade des perturbations internationales, même si elle ne produit que des gains modestes en volume.

Niall van de Wouw, Chief Airfreight Officer de Xeneta, a déclaré : « Dire que 2024 est une « nouvelle aube » est peut-être un peu trop optimiste, mais je pense certainement que c’est le début d’un nouveau cycle pour les compagnies aériennes et les transitaires – et les expéditeurs apprécieront probablement également le retour de la stabilité sur le marché afin qu’ils puissent prévoir plus précisément les coûts de transport des produits qu’ils vendent. »

Les données hebdomadaires du marché pour le mois de décembre montrent que le taux spot moyen mondial du fret aérien a culminé à 2,60 $ US le kg, en hausse de +6 % par rapport à son niveau de novembre, stimulé par une croissance annuelle de la demande de +9 %.

Le taux spot du fret aérien général a toutefois continué d’enregistrer une baisse à deux chiffres de -18 % en glissement annuel. Cela se compare à un ratio de croissance de -25% en novembre par rapport à l’année précédente.

Wouv a déclaré : « Les données de décembre 2023 montrent que le marché a été légèrement plus occupé que prévu, mais nous ne devrions pas être tentés de tirer trop de conclusions de ce qui se passe au cours du dernier mois de l’année, car les vacances de Noël et du Nouvel An en font un mois étrange.

« Nous devons également tenir compte du fait que décembre 2022 a fourni une base de comparaison faible compte tenu de la demande très modérée observée il y a 12 mois.

« Ces dernières données semblent refléter une performance plus forte mais temporaire du marché local sur les voies clés, plutôt que de signaler une économie mondiale qui se porte beaucoup mieux.

« Nos prévisions de marché pour 2024 restent inchangées avec une croissance anticipée de +1 à 2 % de la demande et une hausse de +2 à 4 % de l’offre. »

Alors que l’augmentation du coût de la vie s’étend aux économies avancées, les consommateurs ont opté pour des achats en ligne à prix plus réduits pour remplir leurs listes de courses de Noël, ce qui a augmenté les volumes d’exportation, en particulier en provenance d’Asie.

Toutefois, il convient de noter que les ventes au détail générales en dehors du commerce électronique sont demeurées modérées, surtout si l’on tient compte de l’inflation.

En ce qui concerne l’offre du marché, la capacité mondiale de fret aérien en décembre est restée à un niveau similaire à celui des mois précédents, augmentant de +6 % en glissement annuel par rapport à l’offre mondiale toujours en reprise en 2022.

Le facteur de charge dynamique mondial, l’indicateur de performance du marché de Xeneta qui mesure l’utilisation de la capacité de fret aérien en tenant compte à la fois du volume de fret et du poids du fret transporté et de la capacité disponible, a chuté à 59 % en décembre.

Il s’agit d’une baisse de 1 point de pourcentage par rapport à son niveau de novembre, mais d’une hausse de 3 points de pourcentage par rapport à décembre 2022, la croissance de la demande d’une année sur l’autre ayant dépassé l’augmentation de la capacité de fret.

TLME

0 commentaires